Fragile growth year for Nam

Exports-driven sectors vulnerable

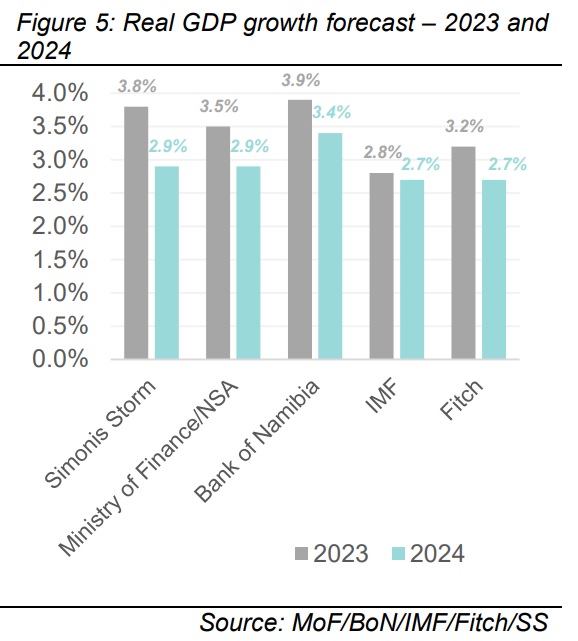

Simonis Storm predicts a moderation in growth for Namibia this year, with forecasts indicating a potential dip to 2.9% as external economic factors pose a threat to the country's export-driven sectors.

Namibia's economic landscape for 2024 is marked by cautious optimism. The country's economy is influenced by global trends, including commodity prices and international supply chain disruptions. Furthermore, Namibia's economic performance is closely linked with South Africa.

The implementation of the Special Economic Zone Bill is a key milestone, addressing some of the prevailing policy uncertainties and slightly bolstering business confidence.

This legislative step contributes to a marginal upturn in net local investment.

Foreign direct investment, maintaining its momentum from 2022, continues to flow, primarily targeting the resource-rich sectors.

However, government finances witness only a slight improvement.

The boost from higher Southern African Customs Union (Sacu) and lower corporate taxes, along with dividends from public commercial entities, is somewhat tempered by the persistent junk status assigned by credit rating agencies, reflecting guarded optimism about Namibia's economic stability.

A notable positive development is the continued advancement in green hydrogen projects.

These initiatives not only diversify the economy, but also position Namibia as a significant player in renewable energy, with operational launches like the hydrogen refuelling station marking key progress.

Trade, diamonds

We anticipate a moderation in growth for 2024, with forecasts indicating a potential dip to 2.9%. This expected deceleration is largely due to external economic factors that could impact Namibia's export-driven sectors.

In the diamond industry, a critical component of Namibia’s economy, we predict a decline in growth rates.

This is closely linked to the persistent downturn in global rough diamond prices since the start of 2022, which could affect export revenues and necessitate strategic adjustments in the sector.

Our analysis for the external trade scenario projects only slight improvements in 2024.

Challenges are expected for both merchandise exports and revenues from Sacu, underscoring the necessity for diversified economic strategies and effective fiscal management.

Debt

The country's fiscal trajectory is improving, with the debt-to-GDP ratio expected to decline over the next years.

As of the second half of 2023, Namibia's debt-to-GDP (gross domestic product) ratio stands at 64.2%, with 16.6% attributed to foreign debt and the remaining 47.6% to domestic debt.

Projections indicate that the total debt is expected to reach N$153.8 billion, constituting approximately 66% of the country's total income.

While this figure is a slight improvement from the previous year's 67.9%, the finance ministry remains vigilant, considering high public debt levels a central concern in fiscal policy considerations for the medium term.

On the fiscal front, our forecasts suggest a reduction in the budget deficit as a percentage of GDP, likely to move from 5.1% in the 2022/23 fiscal year to around 4.1% in 2023/24, and potentially to 4.0% in the subsequent year.

This trend is indicative of a positive shift towards better fiscal balance.

Credit demand and growth, on the other hand, remain weak, but may improve in a normalising economy.

The liquidity in the money market is high due to the gap between money supply growth and credit growth.

Inflation

Global inflation is influenced by factors such as China's flirtation with deflation and the impact of energy market developments. In the USA, inflation remains above 3%, while Europe has seen a sharp decline from double-digit levels.

In Namibia, inflation stood at 5.3% in December, influenced by fuel price cuts. It's expected to moderate towards the mid-point in mid-2024.

South Africa also witnessed a jump in inflation, expected to remain above 5% for several months before trending downwards.

We expect a modest short-term increase, primarily influenced by the global rise in fuel and food prices.

However, the overall trend suggests a gradual slowdown in inflation. Forecasts indicate a deceleration from 6.1% in the previous year to 5.9% in 2023 and further to approximately 4.9% in 2024 in Namibia.

This points toward a movement to a more stable cost of living scenario.

Drivers

This forecast is underpinned by our expectation of persistently lower petrol and food prices, coupled with a stable South African rand, especially in the first quarter of 2024.

These factors are anticipated to be key drivers in moderating headline inflation in Namibia.

Furthermore, we expect that global economic trends, particularly in the energy and food sectors, will continue to exert significant influence on local inflation dynamics.

It is crucial to note that our projections are subject to potential shifts in global economic conditions, policy changes, and unforeseen events that could impact commodity prices and exchange rates. As such, our analysis will remain adaptable, responding to emerging data and trends to provide the most current and relevant economic insights.

Monetary policy

Since February 2022, the Bank of Namibia (BoN) has raised rates by 400 basis points (bps) to 7.75%, 50 bps below the South African Reserve Bank’s (SARB) policy rate. The BoN kept its policy rate unchanged at its December 2023 Monetary Policy Committee (MPC) meeting for the second consecutive time.

Their decision to keep rates unchanged is primarily rooted in the preservation of the currency peg between the Namibian dollar and the South African rand.

This step is vital for ensuring a steady influx of imports, which, in turn, supports the broader goal of maintaining stable prices.

As a result, domestic financial conditions have tightened due to the recent increase in interest rates. It remains unaccommodating for individuals with limited means, further diminishing the affordability of loans for many.

Although there has not been a rate hike at the past two MPC meetings, we only expect rate cuts in the second half of this year.

Based on our analysis of current monetary policy trends, we project that Namibia will likely implement its initial rate cut in the latter half of 2024. We foresee this adjustment to be a modest decrease of 25 bps, which is indicative of a shifting monetary landscape towards a more accommodative stance.

This expected move corresponds with our forecasts of a gradually stabilising economic environment, as reflected in various key economic indicators.

Fed

The US Federal Open Market Committee (FOMC) currently does not see an immediate necessity to cut the Fed funds rate. The market's implied fed funds futures indicate that the first move with certainty is expected at the May FOMC meeting.

Potential interest rate cuts in the United States could offer some support to confidence, although commodity prices are anticipated to remain relatively suppressed throughout the year. The recently released FOMC minutes for the 13 December 2023 meeting revealed a more cautious stance on the initiation of the US rate cut cycle than what markets were anticipating.

The SARB held its MPC meeting on 25 January, deciding to keep interest rates unchanged. The BoN is expected to follow suit with its meeting scheduled for today.

Exchange rate

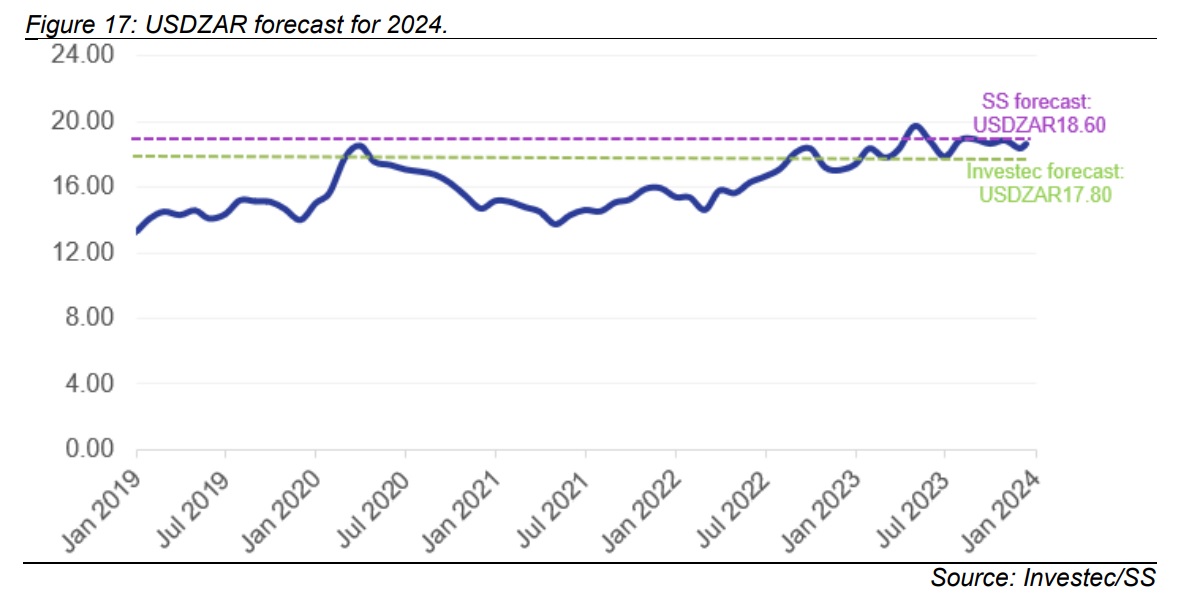

The rand rebounded in second half of last year off the back of weaker US dollar. The rand/US dollar exchange rate averaged 18.65 in the first two months of the last quarter of 2023, compared to 18.65 in the previous quarter and 18.68 in the second quarter.

The rand has displayed minimal volatility so far this year, benefiting from a seasonally supportive period. However, there is still potential for increased volatility, especially as significant market-moving data and events are currently subdued.

Despite its stability, the rand continues to be one of the worst-performing emerging market currencies on a year-on-year basis. The currency's performance is closely tied to US data releases and movements in the US dollar, and it remains relatively weak against major currencies.

Our projection for the US$/rand is 18.60 this year, and Investec has a slightly more optimistic forecast, anticipating the US$/rand at 17.80.

Our forecast implies a belief in the rand's stability compared to 2023, suggesting that while there may not be significant strengthening, there won't be a drastic weakening either.

South Africa

This view is taken even though there are ongoing issues in South Africa that could impact the currency's value.

Problems with Eskom, the state-owned electricity company, and Transnet, the large state-owned ports and rail company, are likely to persist, causing potential disruptions in economic activity.

Additionally, the anticipation of elections brings a degree of uncertainty that could affect investor sentiment and potentially lead to capital outflows, where investors take their money out of South Africa to invest elsewhere.

This can have a negative impact on the value of the rand as demand for it decreases.

Our prediction is that while the South African rand faces some headwinds due to internal challenges and the potential for political uncertainty, it is not expected to experience extreme fluctuations in its value against the US dollar in 2024.

Political landscape

This expectation is based on the assumption that the issues are already known to market participants and thus might be factored into the current value of the rand.

The political landscape, however, presents risks to currency stability.

With elections on the horizon, the potential for the Economic Freedom Fighters (EFF) to gain influence could lead to increased political uncertainty.

Markets typically react unfavourably to uncertainty, especially when it comes with the risk of significant policy changes. If investors perceive a threat to the business environment or economic policy continuity, it could result in capital flight and a weaker rand. - Simonis Storm