Fuelling Namibia’s reputation

Oil coming ‘hard and fast’

Insider news of the oil hunt offshore Namibia leaked this month continues to re-enforce the country's budding reputation as one of the world's top energy exploration hotspots.

Leading energy website Upstream this week reported that TotalEnergies has hit reservoir with a critical appraisal well on its Venus-1A oil discovery, quoting a source saying that “the well has come in on target”.Earlier this month, Upstream quoted a well-placed industry source saying “oil came at them like a train” when Shell re-entered its Graff-1X well. Describing one the tests, using the semi-submersible Deepsea Bollsta, the source told Upstream the flow rate was “big”, with the oil coming “hard and fast”.

“Namibia has become globally sort of the hottest sort of new oil and gas play. So it's drawn a lot of attention. Everyone wants to get involved here,” Cirrus Capital said in a recent podcast on the latest offshore fossil fuel exploration activities.

Should Shell’s and TotalEnergies’ discoveries be commercially viable, investment flows into Namibia could be around US$29 billion, the international consultancy firm Wood Mackenzie estimates. At the current exchange rate, it would be around N$550 billion, close to three times Namibia’s nominal gross domestic product (GDP) last year.

According to Wood Mackenzie, the Shell and TotalEnergies discoveries could potentially deliver about 6.5 billion barrels of oil, resulting in some N$60 billion in royalties and taxes flowing into state coffers annually.

Shell

In February last year, Shell successfully completed drilling its first exploration well (Graff-1) in PEL 39, confirming a working petroleum system and the presence of light oil.

Last April, Shell announced a second Orange Basin discovery, also in PEL 39, with the La Rona-1 well, where the well confirmed hydrocarbon plays at multiple levels.

In March this year, Shell made another light oil discovery, this time in its Jonker-1X well offshore Namibia.

Upstream referred to research carried out by Barclays, which stated that Namibia is a core exploration play for Shell and could account for up to 6% of the supermajor’s market capitalisation if it finds 8 billion barrels of oil in place with a value of US$10 per barrel of oil equivalent.

TotalEnergies

TotalEnergies, also in February last year, announced that it had discovered light oil at its Venus-1X well in the Orange Basin's block 2913B, just to the east of Shell’s Graff-1.

Online news site Energy Voice reported that TotalEnergies this quarter also plans to drill the Nara-1 exploration well in PEL 91, which, according to Upstream, “could be a huge extension of Venus”.

If the western extension of Venus meets expectations, a development could involve multiple floating production, storage and offloading vessels, Upstream said this week.

“If [Nara] is as big as it appears to be, then it could require up to six or seven FPSOs,” each with a capacity of at least 180 000 barrels per day, Upstream quoted a source. A floating production storage and offloading (FPSO) unit is a floating vessel used by the offshore oil and gas industry for the production and processing of hydrocarbons, and for the storage of oil.

Big budget

TotalEnergies has committed US$300 million, half of its global exploration budget for 2023, on a four-well, two-rig exploration and appraisal campaign offshore Namibia. At the current exchange rate, that’s about N$5.7 billion.

The executive chairman of the African Energy Chamber (AEC), NJ Ayuk, described this as “a huge testament of the great potential the Orange Basin holds in making energy poverty history across the African continent while unlocking new revenue streams for global players”.

“The Chamber continues to fight for Africa to maximise upstream activities if we are to achieve energy resilience and a just and inclusive energy transition. Drilling more oil and gas wells, as well as creating free markets and enabling environments which will drive private sector participation, is key for the continent to meet energy security and sustainability as well as economic growth targets,” Ayuk said.

Raising millions

Impact Oil & Gas Limited, a privately-owned, Africa-focused, exploration company with a participating interest in the petroleum exploration licenses of Venus, recently successfully raised US$95 million (about N$1.8 billion) through an open offer to existing shareholders.

The capital raised shall be used, through its wholly owned subsidiary, Impact Oil and Gas Namibia, to fund Impact’s participating interest share of the multi-well drilling programme in Namibia to further evaluate and appraise the Venus discovery – “a world class, light-oil and associated gas field”, according to Impact.

Commenting on Impact’s developments, Ayuk said: “The potential of the Orange Basin in unlocking a new era of energy security and gross domestic product growth for Namibia and its Southern African counterparts are enormous and Impact’s move represents a key step towards unlocking the full potential of the market.”

Seismic investment

Woodside Energy (GOM), a subsidiary fully owned by Australia's Woodside Energy Group, in March executed an option deed with Pancontinental's wholly owned counterpart, Pancontinental Orange. This agreement grants Woodside Energy an exclusive opportunity to obtain a share in a license located offshore Namibia, in proximity to notable oil discoveries made by Shell and TotalEnergies.

As per the agreement, Pancontinental has provided Woodside with an exclusive opportunity to secure a 56% participating interest in PEL 87. In exchange, Woodside will bear the expenses for a 3D seismic survey, encompassing a minimum area of 5 000 square kilometers within the licensed region.

The estimated cost of this survey amounts to US$35 million, or some N$665 million. Additionally, Woodside will pay Pancontinental US$1.5 million (N$28.5 million) as part of the arrangement.

“Energy giants are jockeying for position after major oil discoveries by Shell and TotalEnergies offshore Namibia,” commented Pancontinental non-executive and technical director, Barry Rushworth.

“On-trend, Pancontinental’s PEL 87 has very high potential, with contiguous geology to the discoveries,” he added.

Other majors

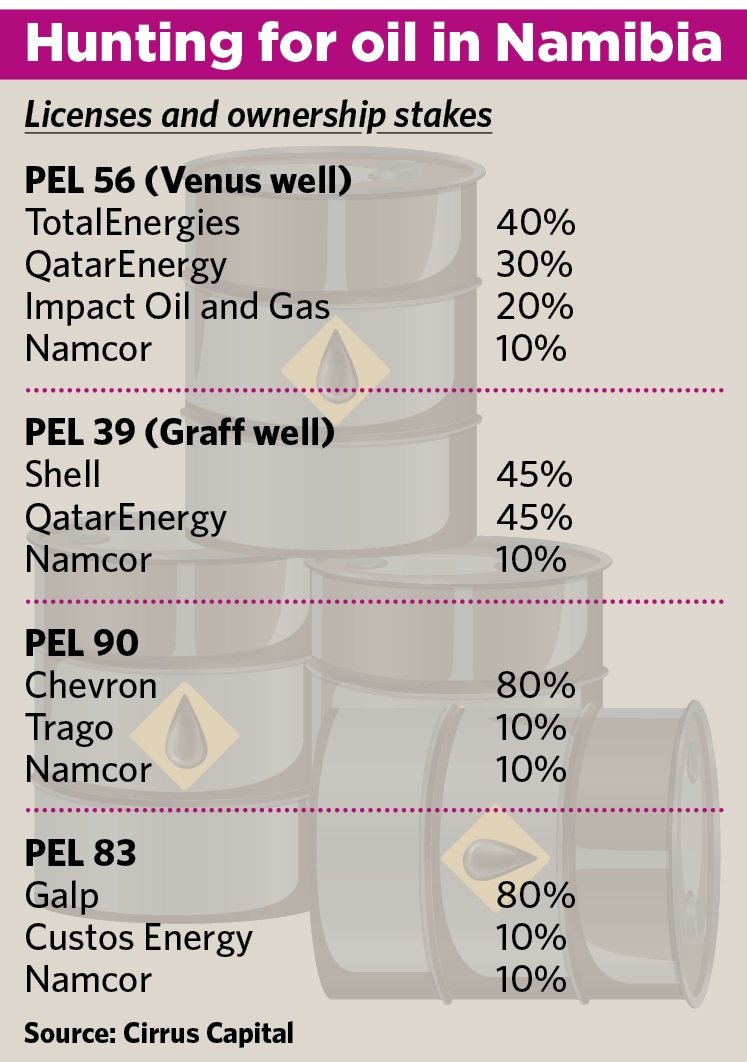

Chevron announced in October that it acquired an 80% working interest in PEL 90 in the Orange Basin after concluding the agreement with Trago Energy (Pty) Ltd., the Namibian subsidiary of Sintana Energy Inc.

"It is rumored that Chevron paid in the region of USD$100 million (about N$1.8 billion) to acquire its stake," according to Cirrus.

PEL 90 is located directly above TotalEnergies’ Block 2913B, where the Venus-1X well was drilled.

In early 2019, the Portuguese multinational energy corporation Galp Energia carried out a 3D seismic survey in PEL 83, which covers a region of about 3 000 km² above Shell’s PEL 39.

According to Cirrus, the Portuguese major has secured an extension for its exploration license to drill a well next year in its block, which lies close to the TotalEnergies, Shell and Kudu discoveries in the Orange Basin.

PEL 83 is located directly west of the Kudu Gas field, which BW Energy is still looking to exploit, and right above Block 2913A, where Shell plc made its Graff 1 light oil discovery. Additionally, Block 2913B, where TotalEnergies’ Venus-1X lies, is adjacent to PEL 83.

Galp has signed a contract with maritime logistics firm SFL Corporation for the utilisation of the company’s Hercules semi-submersible rig at PEL 83, the website Energy Capital & Power reported earlier this month.

Under the terms of the contract, the rig will drill two wells at PEL 83, and will additionally be used for optional well testing and the drilling programme. The duration of the contract has been set at 115 days and drilling is expected to commence by the last quarter of this year.

Government stance

In a report released last year, Cirrus elaborated on its comment that government’s response to the oil discoveries has been reassuringly balanced so far, saying: "There appears to be a commitment to property rights, while government at this stage seems satisfied with the tax regime (35% corporate tax and the additional profit tax). Furthermore, there is no clear effort to increase direct interest in any projects beyond Namcor’s ongoing involvement." Namcor is the state-owned National Petroleum Corporation of Namibia.

"Given the transformative potential of revenues for the state from a commercial discovery, [a] balanced, pragmatic approach is vital to ensure development," Cirrus said.

Although Namibia has a Petroleum Act in place, government is also looking to improve the regulatory framework – including for potential downstream industries, the analysts said.

"It was in this vein that Namibia has been engaging with Qatar to develop a national petroleum development strategy. The aim of this cooperation is to discuss matters on timelines, actions to be taken prior to potential production, shareholding structures, and the significance of skills development in Namibia's oil and gas sector.

"Given Qatar’s experience in oil and gas, the stated purpose is to ensure that Namibia has the best policies in place in terms of effective management of capital from oil and gas exploration and production. Qatar will also reportedly assist the Namibian government in areas of environmental management," Cirrus said.

‘Very optimistic’

Government has been very optimistic on the potential and progress of the offshore hydrocarbons, Cirrus pointed out, adding that media engagements by government officials often convey the belief that the oil discoveries are of a commercial nature, with ambitious timelines of production supposedly expected in the next four to six years.

To date, there have been no official communications as to commerciality, Cirrus stressed.

"We believe that even if commercial viability is announced in the near term, production is at best six to eight years out. Nonetheless, confirmation of a commercial discovery would result in substantial investment inflows and a boost to economic growth even in the nearer term," the analysts said.

No guarantee

However, even if any of the discoveries prove commercially viable, there is no guarantee of further development, Cirrus emphasised.

"Policy certainty is vital to protect investment, particularly the quantum needed to develop a petroleum field. This will require firm commitment to sensible policy, including on tax, property rights and local procurement.

"With growing political uncertainty, firms (especially the majors) will want assurance that any potential changes in political leadership will not adversely impact their investment. Given recent scandals within the ministry of mines and energy, and natural resources in general after the Fishrot exposé, increased transparency is warranted," Cirrus concluded.