NEWS BRIEFS

China widens South America trade highway with Silk Road mega portREUTERS

In September, a group of Brazilian farmers and officials arrived in the Peruvian fishing town of Chancay. The draw: a new Chinese mega port rising on the Pacific coast, promising to turbo charge South America's trade ties with China.

The US$3.5 billion deep water port, set to start operations late this year, will provide China with a direct gateway to the resource-rich region. Over the last ten years, Beijing has unseated the United States as the largest trade partner for South America, devouring its soy, corn and copper.

The port, majority-owned by Chinese state-owned firm Cosco Shipping, will be the first controlled by China in South America. It will able to accommodate the largest cargo ships, which can head directly to Asia, cutting the journey time by two weeks for some exporters.

Beijing and Lima hope Chancay will become a regional hub, both for copper exports from the Andean nation as well as soy from western Brazil, which currently travels through the Panama Canal or skirts the Atlantic before steaming to China.

Oil prices tick up as markets weigh Middle East tensions

REUTERS

Oil prices rose on Friday as geopolitical tensions and oil output disruptions in the U.S., the world's biggest producer, caused by cold weather overshadowed concerns about slow Chinese demand growth and forecasts for ample supply.

Both benchmarks climbed about 2% on Thursday as the International Energy Agency (IEA) joined the Organization of the Petroleum Exporting Countries (OPEC) in forecasting strong growth in global oil demand. This week, WTI is on track to rise about 2% while Brent is set to gain 1%.

On Thursday, the IEA again raised its 2024 global oil demand growth forecast, though its projection remains lower than OPEC's expectations, and said the market looked well supplied because of strong growth outside the producer group.

The IEA expects world oil supply to rise by 1.5 million barrels per day (bpd) to a new high of 103.5 million bpd in 2024, fuelled by record-setting output from the United States, Brazil, Guyana and Canada.

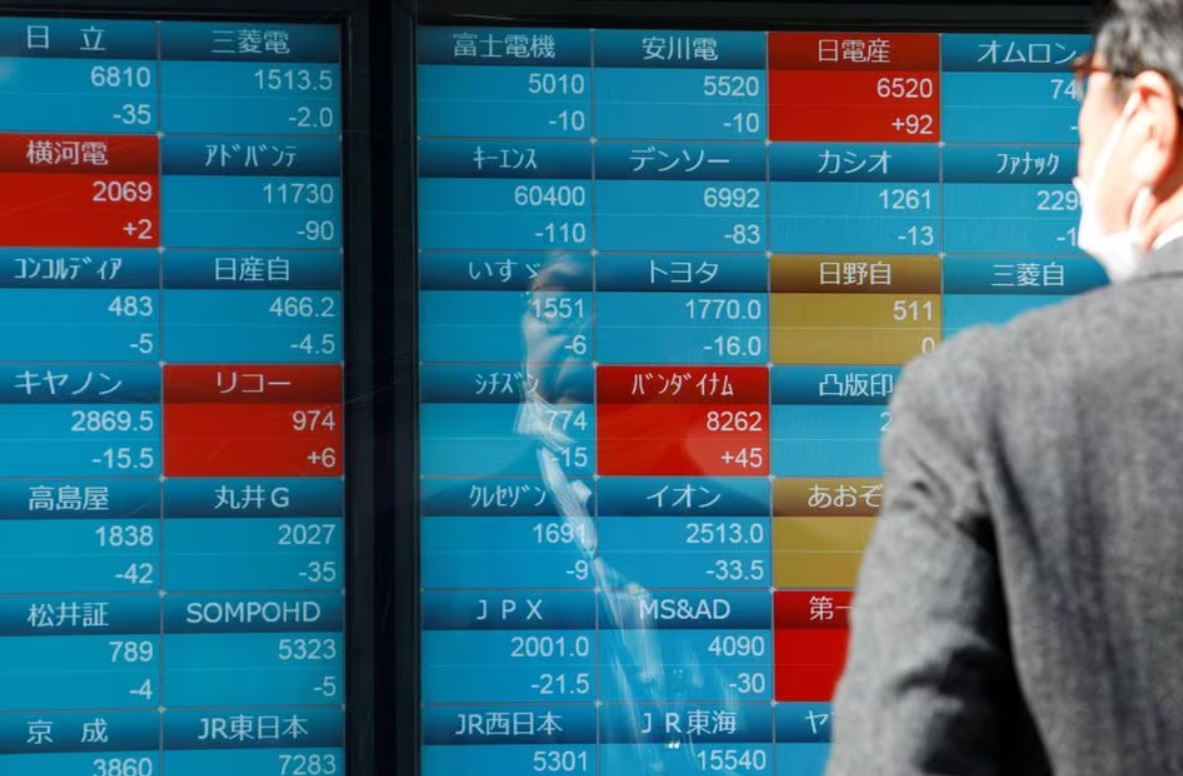

Asian shares bounce on global tech rally, yen loser of the week

REUTERS

Aian shares bounced on Friday, buoyed by a rally in global chipmakers, while the yen was set to end the week with heavy losses as investors pared back bets the Bank of Japan would soon abandon its uber-easy policies.

The stock rally is set to spill over to European markets, with EUROSTOXX 50 futures up 0.4%. The tech-heavy Nasdaq 100 futures climbed another 0.3%, after hitting a record high overnight.

In Asia, MSCI's broadest index of Asia-Pacific shares outside Japan rallied 1.0% on Friday, but was still down 2.7% for the week as jitters about the global interest rate outlook dominated.

Taipei-listed shares of Taiwan Semiconductor Manufacturing surged 6.3% after the chipmaking giant projected 2024 revenue growth of more than 20%. Its U.S. shares soared nearly 10% overnight, fuelling a broad tech rally on Wall Street.